Start Your Business In 7 Steps

Step 1: A Business Idea – Crafting Your Blueprint for Success

The genesis of every great enterprise begins with a powerful business idea. Picture a blank canvas; the possibilities are endless, the potential boundless. Yet, the canvas remains stark until touched by the brush of ingenuity and vision. In this article we will explore how to develop a business idea that not only captivates but also endures the test of time.

The Art of Brainstorming: Unleashing the Power of Creativity

A successful business idea is not merely a flash of inspiration; it is the product of deliberate and methodical brainstorming. Imagine yourself as an artist in the throes of creation, your mind a vibrant palette of colors and concepts.

Begin by asking yourself probing questions that uncover your deepest passions and interests. Passion is the lifeblood of entrepreneurship; it fuels perseverance and drives innovation. Consider:

- What stirs your soul? Reflect on hobbies, interests, and causes that ignite your enthusiasm. A business rooted in passion is more likely to thrive.

- What unique skills and experiences do you bring to the table? Your expertise can be a goldmine for business ideas. Analyze your professional background, talents, and life experiences.

- What problems are crying out for solutions? Entrepreneurs are, at their core, problem-solvers. Identify gaps in the market, everyday annoyances, or societal issues that you can address.

- What are the latest market trends and innovations? Stay attuned to the pulse of the market. Trends can reveal lucrative opportunities and emerging needs.

As you contemplate these questions, let your thoughts flow freely. Sketch ideas, jot down notes, and allow your creativity to roam without constraints. This is your brainstorming phase, where the seeds of your future empire are sown.

Feasibility Analysis: The Crucible of Viability

Once you have a bouquet of ideas, it’s time to subject them to the crucible of feasibility analysis. This step is crucial; it distinguishes the visionary from the dreamer. Conduct a thorough evaluation of each idea’s strengths, weaknesses, opportunities, and threats (SWOT analysis).

Market Size and Demand: Is there a market for your product or service? Examine the market’s breadth and depth. A large, untapped market with growing demand is a fertile ground for your business.

Competitive Landscape: Understand your competition. Who are they? What are their strengths and weaknesses? Analyzing your competitors helps you identify what sets your idea apart and how you can carve a niche.

Financial Viability: Scrutinize the numbers. How much capital will you need to launch and sustain your business? Calculate the potential return on investment (ROI). A financially viable idea promises profitability and sustainability.

Legal and Regulatory Requirements: Every industry has its own legal maze. Research the regulatory landscape. Ensure you can meet all legal requirements and secure the necessary permits and licenses.

Market Research: The Science of Understanding

Next, immerse yourself in market research. This scientific endeavor equips you with invaluable insights into your target audience and competitors. Approach it with the rigor of a detective unraveling a mystery.

Identify Your Target Customers: Who are they? Define your ideal customer profile. Consider demographics, psychographics, and buying behavior. Understanding your customers is paramount to crafting products and services that resonate with them.

Uncover Their Needs and Preferences: Dive deep into what your customers need and desire. Conduct surveys, focus groups, and interviews. What problems are they facing? What solutions are they seeking? The answers will guide your product development.

Determine Their Willingness to Pay: Price sensitivity varies among different customer segments. Gauge how much your potential customers are willing to spend. This will inform your pricing strategy and positioning.

Analyze Market Trends and Innovations: Stay ahead of the curve. Monitor industry reports, market forecasts, and technological advancements. Trends can reveal opportunities for innovation and differentiation.

Evaluate Competitors: Know thy enemy. Study your competitors’ strengths and weaknesses. What are they doing right? Where are they falling short? This intelligence enables you to exploit gaps and improve upon existing offerings.

Identifying a Gap in the Market: The Eureka Moment

Market research will illuminate the contours of your market landscape, revealing gaps that your business can fill. These gaps are opportunities in disguise. They represent unmet needs, underserved segments, or inefficiencies that your business can address.

Look for Patterns: Analyze the data from your market research. Are there recurring themes or pain points? Patterns often point to systemic issues that lack adequate solutions.

Spot Emerging Trends: Innovations and trends can create new gaps in the market. Stay vigilant for emerging consumer behaviors or technological shifts that open up new possibilities.

Analyze Competitor Weaknesses: Your competitors’ shortcomings are your opportunities. Identify areas where they fail to satisfy customer needs or where their offerings are subpar. This is your chance to swoop in with a superior solution.

Validating Your Idea: From Concept to Reality

Before committing resources, validate your business idea. This step involves testing your concept with real customers to ensure its feasibility and desirability.

Create a Minimum Viable Product (MVP): An MVP is a simplified version of your product that includes only its core features. It allows you to test your idea without incurring the full costs of development.

Seek Feedback: Present your MVP to a small group of potential customers. Gather their feedback on usability, functionality, and appeal. Are they willing to pay for it? What improvements do they suggest?

Iterate Based on Feedback: Use the feedback to refine your product. Iteration is key; it ensures your final product meets customer needs and expectations.

Pilot Testing: Launch a pilot test in a limited market. This controlled roll-out allows you to iron out any issues and fine-tune your offering before a full-scale launch.

The Journey Ahead

Developing a business idea is the cornerstone of your entrepreneurial journey. It requires a blend of creativity, analytical thinking, and resilience. By brainstorming passionately, conducting rigorous feasibility analysis, performing meticulous market research, identifying market gaps, and validating your idea, you lay a robust foundation for your business.

Remember, the journey of entrepreneurship is fraught with challenges and uncertainties. Yet, it is also a voyage of discovery, innovation, and profound fulfillment. As you embark on this path, let your vision be your compass and your passion the wind in your sails.

With dedication and perseverance, you can transform your business idea into a thriving enterprise. Embrace the process, learn from each step, and adapt with agility. Your entrepreneurial dreams are within reach; it all begins with a compelling business i

Step 2: Create a Business Plan – Your Blueprint for Success

Creating a business plan is akin to crafting a masterpiece; it is a meticulous process that lays the foundation for your future enterprise. A well-constructed business plan serves as a roadmap, guiding you towards your entrepreneurial goals with clarity and precision. Though the task may seem daunting, it is indispensable for launching and growing a successful business. Let us delve into the art of creating a business plan that not only meets but exceeds your expectations.

Start with a Business Description

The genesis of your business plan begins with a compelling business description. This section is your opportunity to paint a vivid picture of your business, capturing the essence of what it stands for. Begin with the fundamentals:

Business Name and Location: Introduce your business with its name and the location where it will operate. These details anchor your business in a specific context, providing a tangible starting point.

Mission Statement: Your mission statement is the heart of your business. It should be concise, yet powerful, articulating the core purpose and values of your enterprise. A well-crafted mission statement resonates with both your team and your customers, conveying a sense of purpose and direction.

Products or Services: Provide an overview of the products or services your business will offer. Highlight any unique selling points (USPs) that set your offerings apart from the competition. This differentiation is crucial; it is what makes your business stand out in a crowded market.

Conduct a Market Analysis

A thorough market analysis is the cornerstone of a robust business plan. It involves an in-depth examination of your target market and the competitive landscape.

Target Market: Define your target market with precision. Identify the demographics, psychographics, and behaviors of your potential customers. Understanding who they are, what they need, and how they make purchasing decisions is vital for tailoring your products and marketing strategies.

Market Size and Trends: Assess the size of your market and its growth potential. Are you entering a booming market or a niche segment? Analyzing market trends helps you identify opportunities and anticipate changes.

Competitor Analysis: Scrutinize your competitors to understand their strengths and weaknesses. What are they doing well? Where do they fall short? This analysis not only highlights your competitive advantage but also uncovers gaps in the market that your business can fill.

SWOT Analysis: Conduct a SWOT analysis to evaluate your business idea’s strengths, weaknesses, opportunities, and threats. This strategic tool helps you prepare for potential challenges and leverage opportunities.

Develop a Marketing and Sales Plan

The marketing and sales plan is where your business strategy comes to life. It outlines how you will attract and retain customers, driving revenue and growth.

Marketing Strategy: Your marketing strategy should be a symphony of creativity and analysis. Define your brand positioning, messaging, and value proposition. Choose the right mix of marketing channels—digital, social, traditional—that resonate with your target audience.

Customer Acquisition: Detail your plan for acquiring customers. Will you use content marketing, SEO, paid advertising, or partnerships? Each tactic should be tailored to reach your audience effectively and efficiently.

Sales Strategy: Outline your sales process, from lead generation to closing deals. Specify your sales channels—direct sales, online platforms, retail partnerships—and the techniques you will employ to convert prospects into customers.

Revenue Model: Explain how your business will generate revenue. Will you sell products, offer subscriptions, provide services, or utilize a different model? Your revenue model should be clear and aligned with your market research.

Create Financial Projections

Financial projections are the numerical backbone of your business plan. They provide a forecast of your business’s financial health and viability.

Revenue Projections: Estimate your expected revenue over the next 3-5 years. Base these projections on realistic assumptions derived from your market research and sales strategy.

Expense Forecast: Detail your anticipated expenses, including startup costs, operational expenses, and marketing budgets. Understanding your cost structure is essential for managing your finances effectively.

Profit and Loss Statement: Create a profit and loss statement to project your business’s profitability. This statement should include revenue, costs, and net profit, providing a clear picture of your financial performance.

Cash Flow Statement: A cash flow statement tracks the inflows and outflows of cash, ensuring you can meet your financial obligations. This projection is crucial for maintaining liquidity and avoiding cash crunches.

Balance Sheet: A balance sheet provides a snapshot of your business’s financial position, listing assets, liabilities, and equity. It helps you understand your business’s net worth and financial stability.

Funding Requirements: If you need external funding, specify how much you require, how you will use it, and your strategy for securing it. Whether you seek loans, investors, or crowdfunding, your financial plan should demonstrate your business’s potential for returns.

Develop an Operational Plan

The operational plan is the blueprint for running your business day-to-day. It outlines the logistics, processes, and structures that will keep your business functioning smoothly.

Business Structure: Define the legal structure of your business—sole proprietorship, partnership, LLC, corporation. This decision affects your liability, taxes, and governance.

Management Team: Introduce your management team, highlighting their expertise and roles. A strong, experienced team can inspire confidence in your business’s potential.

Operational Processes: Detail the processes and workflows that will drive your business operations. From production to delivery, customer service to quality control, every aspect should be planned meticulously.

Supply Chain: Describe how you will source materials or products. Identify your suppliers, logistics partners, and any contingency plans for supply chain disruptions.

Regulatory Compliance: Ensure you understand and comply with all legal and regulatory requirements. Obtain necessary permits, licenses, and adhere to industry standards.

Review and Revise Your Plan

A business plan is not a static document; it is a dynamic, evolving blueprint. Regularly review and revise your plan to reflect changes in the market, your business, and your goals.

Continuous Improvement: As your business grows, revisit each section of your plan. Update your market analysis with new data, refine your strategies based on performance, and adjust financial projections as needed.

Adaptability: The ability to adapt is a hallmark of successful businesses. Stay agile, responsive to feedback, and willing to pivot when necessary. Your business plan should be a living document that evolves with your business.

Conclusion

Creating a business plan is an art and a science. It requires a blend of creativity, strategic thinking, and meticulous planning. By starting with a compelling business description, conducting thorough market analysis, developing robust marketing and sales strategies, crafting detailed financial projections, and outlining efficient operational processes, you set the stage for success.

Your business plan is more than a document; it is the embodiment of your vision, aspirations, and strategic thinking. It guides you through the labyrinth of entrepreneurship, helping you navigate challenges and seize opportunities. With dedication and perseverance, your business plan can transform your entrepreneurial dreams into reality.

Step 3: Secure Funding – Fueling Your Business Journey

Securing funding is not merely about gathering the resources needed to start your business—it’s about igniting the engine of your enterprise and propelling it towards success. In this guide, we will explore the intricate process of determining your funding needs, navigating through various financing options, and establishing a budget to effectively manage your finances. Let this be your comprehensive roadmap to securing the financial backing necessary to turn your visionary business idea into a tangible reality.

Determine Your Funding Needs

The quest for funding begins with a clear understanding of your financial requirements. This initial step is pivotal as it sets the foundation for your funding strategy:

Assess Initial Costs: Start by evaluating all the startup costs your business will face. This includes expenses such as equipment, inventory, rent, marketing, and salaries. Each element should be meticulously calculated to avoid financial shortfalls in the future.

Industry and Size Considerations: The amount of funding needed can vary significantly depending on the industry and the intended scale of your business. For instance, a tech startup may require substantial initial investment in research and development, whereas a retail store might need more for inventory and leasehold improvements.

Realistic Projections: It is crucial to base your estimates on realistic projections. Overly optimistic forecasts can lead to financial strain, while conservative estimates may hinder your ability to grow. Striking the right balance is key.

Explore Financing Options

With a clear picture of your funding needs, it’s time to explore the myriad financing options available. Each option comes with its own set of advantages and challenges:

Loans: Loans are a traditional source of funding, including bank loans, Small Business Administration (SBA) loans, and personal loans. Qualifying for a loan typically requires a good credit score and a robust business plan. Loans are ideal for businesses that need significant capital upfront and have the capacity to repay the debt over time.

Grants: Grants are an excellent source of funding for businesses focused on research, technology, or social impact. Unlike loans, grants do not require repayment, making them highly attractive. However, they are competitive and demand a compelling application that highlights the innovative or societal value of your business.

Investors: Investors offer capital in exchange for equity in your business. Angel investors and venture capitalists are the most common types of investors in the startup space. Attracting investors requires not only a solid business plan but also a persuasive pitch that outlines the potential for high returns on their investment.

Create a Budget

Securing the funding is just the beginning; effectively managing it is what determines long-term success. A well-structured budget is essential for steering your business in the right direction:

Income Sources: List all potential sources of income, including sales, loans, and investor funding. This will give you a clear view of your financial inflow.

Fixed and Variable Expenses: Detail all expenses, both fixed (like rent and salaries) and variable (such as marketing campaigns and seasonal inventory). Understanding where your money goes each month is crucial for financial management.

Net Profit Calculation: Subtract total expenses from total income to determine your net profit or loss. This calculation will help you gauge the financial health of your business and make necessary adjustments.

Review and Adjust Your Funding and Budget

The dynamic nature of business necessitates periodic reviews and adjustments to your funding and budget:

Regular Reviews: Regularly assess your financial status and budget compliance. This helps you stay on track and make informed decisions quickly when financial adjustments are necessary.

Scalability and Growth: As your business grows, your financial needs will evolve. Be prepared to seek additional funding or adjust your budget to accommodate expansion, new product lines, or unforeseen expenses.

Adaptability: The ability to adapt your financial strategy to changing circumstances is a hallmark of a resilient business. Stay agile and open to modifying your budget as needed to align with your business’s current needs and future aspirations.

Conclusion

Securing funding is a vital step in the life cycle of any business, providing the financial foundation necessary for growth and stability. By thoroughly determining your funding needs, exploring a range of financing options, and meticulously managing your finances through a well-planned budget, you set the stage for a financially sound business. Remember, the journey of securing funding is not a one-time task but a continuous process that requires attention, adaptability, and strategic foresight. With careful planning and proactive financial management, you can ensure your business not only survives but thrives in the competitive marketplace.

Step 4: Choose a Business Structure – Crafting the Foundation of Your Enterprise

Selecting the right legal structure is like laying down the keel of a ship—it’s the backbone on which your business will navigate the unpredictable seas of commerce. This choice will profoundly affect your personal liability, tax obligations, and capacity to attract investment. In this detailed exploration, we shall walk through the different types of business structures, illuminating each to help you anchor your business in the most advantageous legal harbors.

Understanding Your Options

The architecture of your business’s legal structure is crucial. It determines your vulnerability to risks, influences financial decisions, and defines the framework within which your business will operate.

Sole Proprietorship

This is the simplest form of business ownership and the most straightforward to establish. In this structure, the business and the owner are legally indistinguishable.

Advantages:

- Ease of formation and minimal bureaucratic overhead.

- Unparalleled control over decision-making processes.

- Tax simplicity, as earnings are taxed on a personal level.

Disadvantages:

- Unlimited personal liability, meaning personal assets are at risk if the business incurs debt or legal actions.

- Difficulty in raising capital, as sole proprietorships rarely attract investors.

Partnership

This structure involves two or more individuals who agree to share the profits or losses of a business. A partnership can be general, where all partners manage the business and assume responsibility for its debts, or limited, where some contribute capital and enjoy profits but do not partake in daily operations.

Advantages:

- Simplicity of setup and low start-up costs.

- Combined knowledge, skills, and resources of multiple partners.

- Tax advantages, as earnings are passed through to partners and taxed on a personal level.

Disadvantages:

- Personal liability for business debts, which can extend to personal assets.

- Potential for conflicts between partners, which can disrupt business operations.

Limited Liability Company (LLC)

An LLC is a hybrid structure that offers the flexibility of a partnership with the liability protection of a corporation. Owners are considered members and not partners or shareholders.

Advantages:

- Protection from personal liability, safeguarding personal assets from business debts.

- Tax flexibility, allowing members to choose how they are taxed.

- Fewer regulations than corporations, providing a simpler operational framework.

Disadvantages:

- More complex and costly to establish than a sole proprietorship or partnership.

- Possible self-employment taxes, which can be higher than those of a corporation.

Corporation

A corporation is a legal entity that is separate and distinct from its owners, who are shareholders. This structure is more complex and suited for businesses that plan significant growth or seek to raise capital through stock.

Advantages:

- Limited liability for shareholders, protecting personal assets.

- Ability to raise funds through the sale of stock.

- Perpetual existence, as the entity does not dissolve with the death of a shareholder.

Disadvantages:

- Complex and costly to establish and maintain, with more regulatory requirements.

- Risk of double taxation, first on the corporate income and then on dividends paid to shareholders.

Making the Right Choice

The decision on which structure to choose involves balancing the scales of control, liability, and fiscal responsibility. Here are a few considerations:

- Risk Management: Evaluate how much personal risk you are willing to assume in your business operations.

- Financial Strategy: Consider your plans for funding and growth; different structures facilitate different opportunities for capital infusion.

- Tax Planning: Understand the tax implications of each structure, as they can significantly affect your net income.

- Future Aspirations: Reflect on the long-term vision for your business, as the structure can influence your ability to scale, adapt, and evolve.

Consulting the Experts

Navigating the complexities of legal structures is not a voyage to undertake alone. Consult with a seasoned lawyer and a trusted accountant to delve deep into the implications of each structure. Their expert guidance will tailor your decision to your specific business needs and personal circumstances, ensuring that your chosen structure optimally supports your entrepreneurial ambitions.

Conclusion

Choosing the right business structure is one of the most strategic decisions you will make, akin to selecting the materials from which to build a vessel that will weather the storms of business. Each option carries its distinct advantages and inherent risks. By carefully considering your business needs, consulting with experts, and understanding each structure’s implications, you can lay a solid foundation that supports robust growth, minimizes risk, and enhances operational efficiency. This meticulous approach will ensure that your business not only survives but thrives in the competitive business landscape.

This exploration, crafted with a meticulous attention to detail, guides you through one of the most crucial decisions in shaping your business’s future, setting the stage for success in the vibrant world of entrepreneurship.

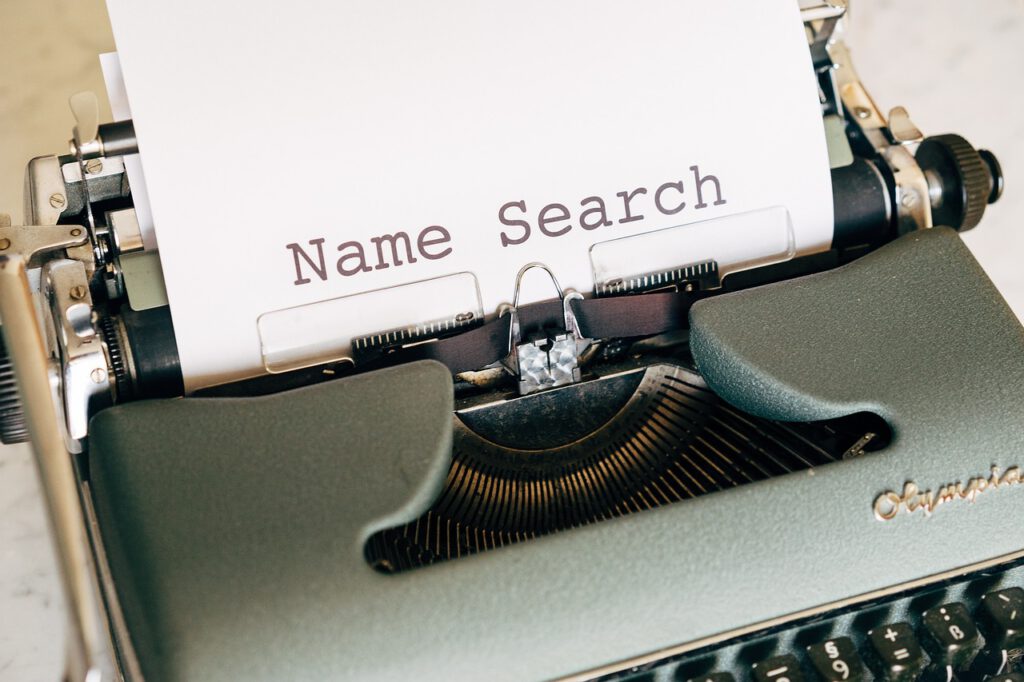

Step 5: Register Your Business – Navigating the Legal Landscape

Registering your business is a pivotal step that transforms your entrepreneurial vision into a recognized legal entity. This formalization not only anchors your business in the regulatory framework but also paves the way for operational legitimacy and financial security. In this meticulously crafted guide, we’ll navigate the intricate process of registering your business, obtaining the necessary licenses and permits, and ensuring compliance with all legal requirements.

Choosing a Business Name

The first stroke in the canvas of your business identity is selecting a name. This name will be the cornerstone of your brand and your first impression on the market.

Reflect Your Business’s Nature: Choose a name that encapsulates the essence of what your business offers. It should resonate with your target audience and reflect the unique value proposition of your products or services.

Ensure Uniqueness: Conduct a thorough search to ensure that your chosen name isn’t already in use or trademarked by another entity. This step is crucial to avoid legal conflicts and brand confusion.

Consider Online Presence: In today’s digital age, check the availability of the corresponding domain name and social media handles. Having a consistent name across all platforms enhances your brand’s visibility and accessibility.

Registering Your Business

Once a name is chosen, the next step is to legally register your business. This process varies depending on your chosen structure and location but generally involves the following steps:

State Registration: Typically, you’ll register with your state’s Secretary of State office. This involves filing a registration form and paying a fee. For LLCs and corporations, this includes submitting articles of organization or incorporation, which outline the fundamental aspects of your business and its operational blueprint.

Local Business Licenses: Depending on your business type and location, you may also need to obtain a business license from your local government. This license serves as permission to operate within a certain locality under the guidelines set forth by local law.

Obtaining Licenses and Permits

The type of business you operate may require specific licenses or permits:

Industry-Specific Permits: For example, a restaurant might need health department permits, while a construction business may need building or environmental permits.

Professional Licenses: Some professions require state-issued licenses, such as legal, medical, or real estate services.

Local Permits: These can include signage permits, zoning permits, or fire department permits if your business location needs to meet specific safety standards.

Utilize resources like the Small Business Administration (SBA) website, which offers a comprehensive breakdown of federal, state, and local permits and licenses necessary for various business types.

Applying for an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is essential if you plan to hire employees or if your business entity is a partnership, LLC, or corporation:

IRS Assignment: The EIN is a nine-digit number assigned by the IRS used to identify your business for tax purposes.

Application Process: Applying for an EIN is straightforward and free via the IRS website. The number is issued immediately upon completing the online application.

Complying with Tax and Regulatory Requirements

With your business officially registered and licensed, the next step is ensuring compliance with tax and regulatory obligations:

Sales Tax Permit: If you’re selling goods or certain services, you might need to collect and remit sales tax, requiring a sales tax permit from your state.

State Revenue Registration: Register with your state’s department of revenue to handle state income taxes and other state-specific obligations.

Annual Filings and Tax Returns: Stay current with federal, state, and possibly local tax returns, as well as any required annual reports or filings.

Consult a Professional: Given the complexity of tax laws and business regulations, consulting with a tax professional or accountant is advisable. They can provide guidance tailored to your specific situation, helping to minimize liability and ensure compliance.

Conclusion

Registering your business and securing the necessary licenses and permits is a critical foundation for your venture’s success and legality. This process not only legitimizes your business but also shields it from potential legal issues that could jeopardize its future. By methodically following these steps, you establish a strong legal framework that supports your business’s growth and ensures compliance with all pertinent regulations. Equip yourself with patience and attention to detail as you embark on this phase, setting the stage for a thriving and compliant business entity. This guidance, rich with detail and precision, is designed to steer you confidently through the complexities of business registration and legal compliance, ensuring your venture is built on solid ground.

Step 6: Set up Your Business Operations – Building a Foundation for Efficiency and Success

Once your business is legally established, the next critical phase is setting up your operational framework. This stage is about laying down the operational gears and cogs that will keep your business running smoothly and efficiently. From finding the ideal location to hiring the right team and managing your finances, each step should be meticulously planned and executed. In this guide, we’ll navigate through the essential steps to establish robust business operations, ensuring your enterprise operates like a well-oiled machine.

Finding the Ideal Location

Retail or Service-Based Businesses: If your business requires physical interaction with customers, selecting the right location is paramount. Look for spaces that have high foot traffic, are easily accessible, and are close to your target market. Factors like neighborhood safety, parking availability, and the condition of the premises also play crucial roles in attracting and retaining customers.

Home-Based Businesses: For entrepreneurs setting up a home office, ensure that your workspace is conducive to productivity. This means having a dedicated area equipped with the necessary technology and comforts that foster a professional working environment. Compliance with zoning laws and home business regulations is also essential.

Hiring Employees

Creating Job Descriptions: Clearly define the roles and responsibilities for each position. This clarity helps during the recruitment process and ensures you attract candidates who are a good fit for the job.

Compliance with Labor Laws: Familiarize yourself with federal and state employment laws to ensure your business adheres to regulations concerning wages, hours, and benefits. This compliance helps avoid legal complications and fosters a fair workplace.

Recruitment Process: Implement a thorough hiring process that includes background checks and reference verifications. Hiring the right people is critical—they are not just employees but ambassadors of your brand.

Establishing a Bookkeeping System

Choosing Accounting Software: Tools like QuickBooks, Xero, or other reliable accounting software are essential for efficient financial management. These systems help track your income, expenses, and other financial activities.

Maintaining Accurate Records: Keep meticulous records of all financial transactions. Proper bookkeeping simplifies tax filing, aids in financial analysis, and supports better decision-making.

Setting Up a Business Bank Account

Separation of Finances: Open a dedicated business banking account to separate your personal finances from your business dealings. This separation is crucial for financial clarity and simplifies accounting processes.

Choosing the Right Bank: Select a bank that offers favorable terms, low fees, and strong online banking tools. Consider banks known for their robust small business support services.

Developing Standard Operating Procedures (SOPs)

Crafting SOPs: Develop comprehensive Standard Operating Procedures for all critical tasks and operations within your business. SOPs should cover daily routines, customer service protocols, emergency procedures, and more.

Training Staff on SOPs: Ensure that all team members are well-trained on these procedures. Consistent application of SOPs ensures operational efficiency and quality control across all aspects of your business.

Conclusion

Setting up your business operations is a crucial step toward laying a foundation for success. By strategically choosing your location, carefully hiring and training employees, implementing solid financial systems, and developing standard operating procedures, you prepare your business to operate smoothly and grow sustainably. This preparation not only sets the stage for efficient daily operations but also positions your business as a credible and reliable entity in the marketplace. Taking the time to establish these operations with care will pave the way for a prosperous and dynamic future for your enterprise.

Step 7: Launch Your Business – Igniting Your Vision into Reality

Launching your business is the culmination of your hard work, planning, and vision. This step transforms your preparation into action, marking the start of your business’s journey in the competitive marketplace. A successful launch can set the tone for its future, creating momentum and establishing its presence among potential customers and within the industry. Let’s embark on this final step with a comprehensive strategy that ensures your launch is not just a beginning but a grand entrance into the business world.

Final Preparations Before the Launch

Revisit Your Business Plan: Before you unveil your business to the world, take one last look at your business plan. This is your roadmap and should reflect all your strategies for marketing, operations, and financial projections. Ensure every detail aligns with your current goals and resources.

Check Legal and Compliance Issues: Ensure that all legalities are sorted, including permits, licenses, and insurance. Double-checking these details can prevent unforeseen issues that could derail your launch or future operations.

Finalize Your Branding: Your brand is the identity that will resonate with your customers. Ensure your logo, business name, and overall design are coherent and professionally crafted. These elements should be consistently applied across all your marketing materials and digital platforms.

Establishing Your Online Presence

Develop a Professional Website: In today’s digital age, a website is crucial. It should be user-friendly, aesthetically pleasing, and optimized for search engines. Ensure it accurately represents your brand and makes it easy for customers to learn about your products or services and make purchases or inquiries.

Social Media Engagement: Establish profiles on relevant social media platforms to reach your target audience. Use these platforms to build relationships with your customers by engaging with them, sharing valuable content, and responding to their feedback.

Email Marketing: Build an email list and start engaging potential customers with newsletters and promotional offers. This direct line of communication is invaluable for building customer relationships and driving sales.

Soft Launch

Testing the Waters: Consider a soft launch involving a select group of customers or a limited geographical area before going full scale. This approach allows you to gather data, adjust operations, and improve customer experience based on feedback.

Gather Feedback: Use the soft launch as an opportunity to see what works and what doesn’t. Customer feedback is golden—take it seriously, and be ready to make quick adjustments.

Refine Your Offerings: Based on the feedback, refine your products or services. It’s essential to address any issues before the full-scale launch to avoid costly mistakes.

Marketing and Promotion Strategies

Create Buzz with Pre-Launch Offers: Generate excitement and anticipation by offering early bird specials or exclusive previews to your email subscribers or social media followers.

Leverage Local Media: Reach out to local newspapers, radio stations, and TV channels. Getting featured in local media can increase your visibility significantly.

Host a Launch Event: Whether online or in-person, a launch event can be a powerful tool to drum up excitement. Use this event to showcase your products or services, share your business story, and network with potential customers and other businesses.

Influencer Collaborations: Partner with influencers who align with your brand to reach a broader audience. Their endorsement can lend credibility and attract their followers to your business.

Building Partnerships

Network with Other Businesses: Build relationships with businesses that complement yours. These partnerships can lead to collaborative promotions, referrals, and a broader customer base.

Engage with Community: Show that your business cares. Engage in community service or sponsor local events. This not only builds goodwill but also increases your business’s visibility within the community.

Continuous Improvement

Monitor and Adapt: Keep a close eye on all aspects of your business post-launch. Use analytics to track your sales, website traffic, and customer engagement. Being agile and ready to adapt to market demands or operational challenges is crucial.

Innovate and Update: As your business grows, continuously look for ways to innovate and improve your offerings. Stay updated with industry trends and adjust your business strategies accordingly.

A Message to Aspiring Entrepreneurs

As you stand on the brink of launching your business, remember that this is just the beginning of a dynamic journey. Each day offers new opportunities to learn, to refine, and to excel. Be bold in your aspirations, steadfast in your commitment, and meticulous in your approach. The road ahead will have its share of challenges, but with perseverance and a relentless pursuit of excellence, your business can thrive. Let your passion be the light that guides you through uncertainties and your vision be the anchor that keeps you focused. Here’s to the start of something remarkable—your business’s success story.